The Money Mistakes That Make Divorce Harder (and How to Avoid Them)

Divorce sits at the intersection of law, emotion, and money. Most people give all their attention to the legal fight or the emotional recovery. The financial side often gets pushed to the background until it is too late. The decisions made during this period can shape the next decade of life. The encouraging part is that smart strategy and the right team make a measurable difference.

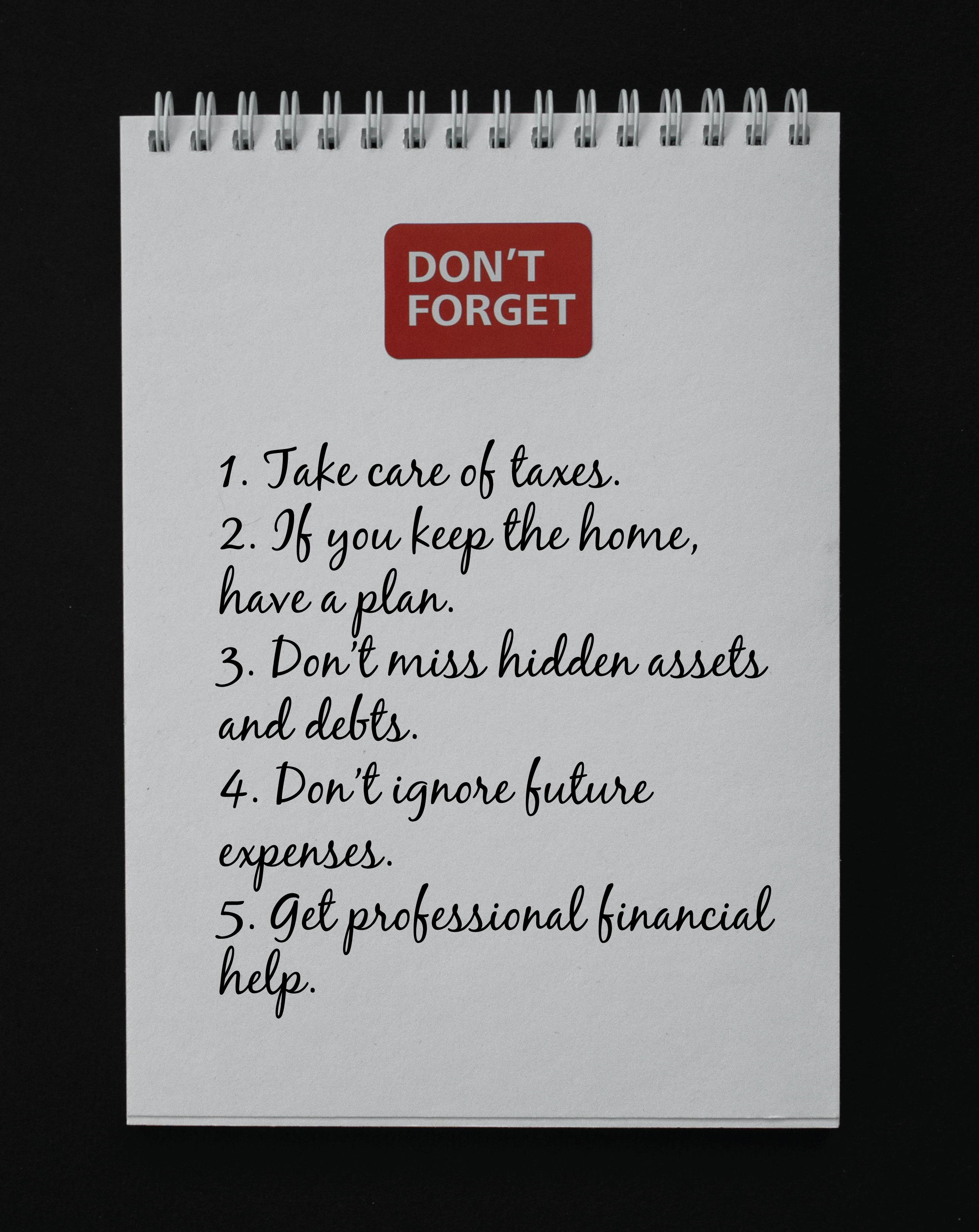

These are the five financial mistakes I see most often, and how to avoid them.

Mistake 1: Ignoring Taxes

Numbers on paper can be misleading. A traditional IRA and a savings account might both show a value of fifty thousand dollars, but only one can be accessed freely. The other may be taxed on the way out and not available until retirement. If you divide assets based on face value alone, the result can be very uneven.

The solution is to value assets after taxes. A CDFA can model how taxes change the picture so you are not blindsided later.

Mistake 2: Keeping the Home Without a Plan

The family home holds memories and stability, particularly for children. The challenge is that a house is not just a mortgage payment. It comes with taxes, utilities, insurance, repairs, and future upgrades that can strain a single income. Without a realistic plan, the home becomes a financial burden rather than a source of comfort.

A post divorce budget needs to be completed before deciding who keeps the house. This is also the stage where a CDLP is critical. Determining mortgage eligibility, buy out options, and long term housing feasibility is not something most people or even most attorneys can assess on their own. A CDLP brings mortgage guidelines, financing structure, and support language into the planning process so you are not set up to fail later.

Mistake 3: Missing Hidden Assets and Debts

Hidden assets are not always intentional. Health savings accounts, airline miles, crypto wallets, or old PayPal balances get forgotten more often than you think. On the debt side, credit cards or personal loans may exist without one spouse realizing it.

The fix is to create a master inventory of accounts, apps, rewards, cards, loans, and memberships. A CDFA knows the right questions to ask and the places to look.

Mistake 4: Ignoring Future Expenses

Divorce settlements that focus on today ignore the reality that expenses evolve. Children need orthodontics, sports fees, laptops, and eventually college. Medical costs rise. Retirement contributions continue. Inflation never takes a break.

Put expectations in writing during the divorce. Even broad guidelines prevent conflict years later.

Mistake 5: Not Getting Professional Financial Help

Trying to DIY the financial side of divorce is like trying to fix your own root canal. It seems cheaper until the consequences arrive. Divorce is one of the most complex financial transactions most people will ever face.

A CDFA provides financial clarity. A CDLP provides mortgage and housing clarity. Attorneys guide legal decisions. Therapists guide emotional healing. Together they help you build a sustainable future rather than just divide the past.

Divorce does not have to derail financial stability. When you avoid these common mistakes, you protect your cash flow, your credit, and your peace of mind as you move into your next chapter.

Source: https://institutedfa.com/top-5-money-mistakes-divorcing-couples-make-how-avoid-them/