Mediation vs. Collaborative Divorce

Mortgage Planning Guidance from Theresa Springer, CDLP®

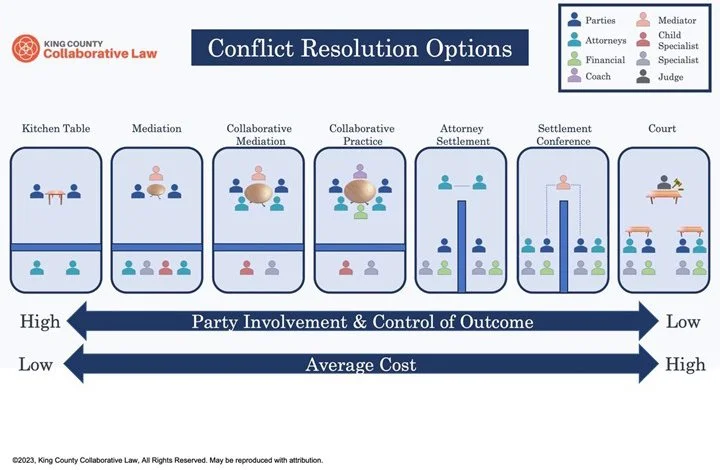

Divorce is a major life transition—one that can have lasting effects on your finances, your housing, and your future. While mediation and collaborative divorce offer peaceful alternatives to litigation, each approach offers different levels of support—especially when it comes to homeownership and mortgage financing.

As a Certified Divorce Lending Professional (CDLP®), I specialize in helping divorcing homeowners understand their options and protect their ability to retain or purchase a home. Whether you’re choosing mediation or collaborative divorce, my role is to provide expert guidance that bridges the gap between legal decisions and real-world mortgage solutions.

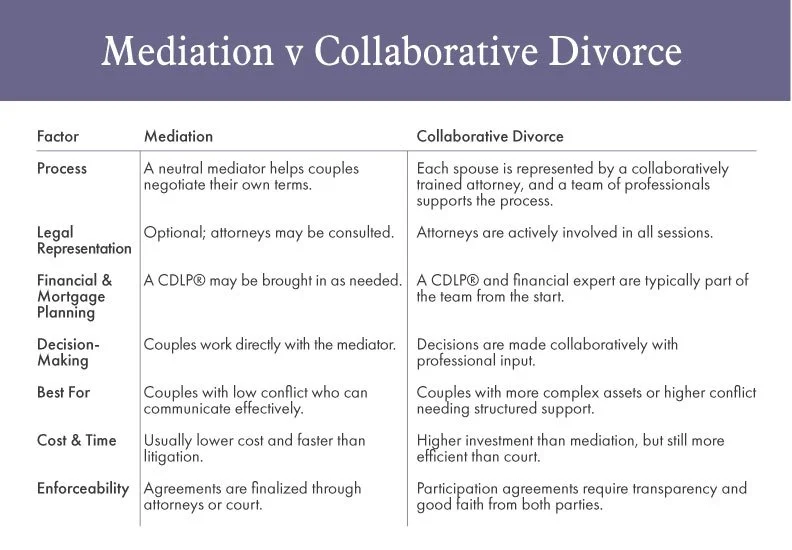

Mediation vs. Collaborative Divorce: What's the Difference?

How I Support You as a CDLP® in Both Processes

As a Certified Divorce Lending Professional, I offer specialized guidance that’s essential when navigating mortgage and real estate decisions during divorce. My role is not the same as a CDFA® or financial planner—my focus is on how divorce-related financial decisions affect your mortgage eligibility and long-term housing goals.

In Mediation

I can be brought in as a financial neutral, offering objective, mortgage-specific insight that helps both parties:

Understand home retention vs. sale options

Assess home equity division fairly

Evaluate how the settlement affects mortgage qualification

My role is to ensure both parties make informed decisions that are financially viable in the lending world—not just on paper.

In Collaborative Divorce

In this model, I’m typically part of the core team from the beginning. I collaborate with attorneys, financial planners, and mental health professionals to:

Proactively align financial settlements with mortgage lending guidelines

Structure agreements that preserve homeownership eligibility

Prevent costly surprises by ensuring all housing decisions are realistically achievable

Why Mortgage Expertise Matters in Divorce

Not everything that is legal is financially possible in the eyes of a lender. That’s where I come in—to translate your divorce settlement into actionable, mortgage-friendly outcomes that protect your future.

Move Forward with Confidence

Whether you choose mediation or collaborative divorce, I’m here to support you every step of the way. As your CDLP®, my goal is to make sure you understand your mortgage options and feel empowered to make housing decisions that align with your post-divorce life.

Contact me today to schedule a consultation and take the first step toward financial clarity and homeownership security.